What is a virtual card? One card unlocks international payments in multiple scenarios

发布时间:2024-07-03

Along with the omni-channel layout of going overseas, the demand of enterprises for diversified international payment scenarios has increased dramatically. For small and medium-sized overseas enterprises in the start-up period, the traditional payment mode is not well matched with the ever-changing payment demand, and they will also face a series of complexity and uncertainty. How to reduce costs and increase efficiency in the process of overseas multi-scenario payment? Understanding the virtual card will give you the answer.

What is a virtual card?

Virtual card, is a card payment tool without physical form, issued by banks or financial institutions, with all the functions of traditional credit cards. The basic information of a virtual credit card (such as card number, expiration date and CVV code) is provided in digital form, and users can use the virtual card to make payments in shopping, payment, transfer and other scenarios.

In addition, AIGC tools like ChatGPT and Midjourney, which have become more popular recently, can also use virtual cards to make payments when upgrading their subscriptions.

What are the features of virtual cards?

1、No physical card: virtual cards do not require a physical card, all the card information is stored in the digital form of the account, safe and stable.

2、High security: virtual cards usually require users to register and activate through the identity verification process, reducing the risk of loss or theft.

3. Good convenience: users do not need to carry a physical card, they only need to remember or save the card information to make payments.

Image source: Qbit

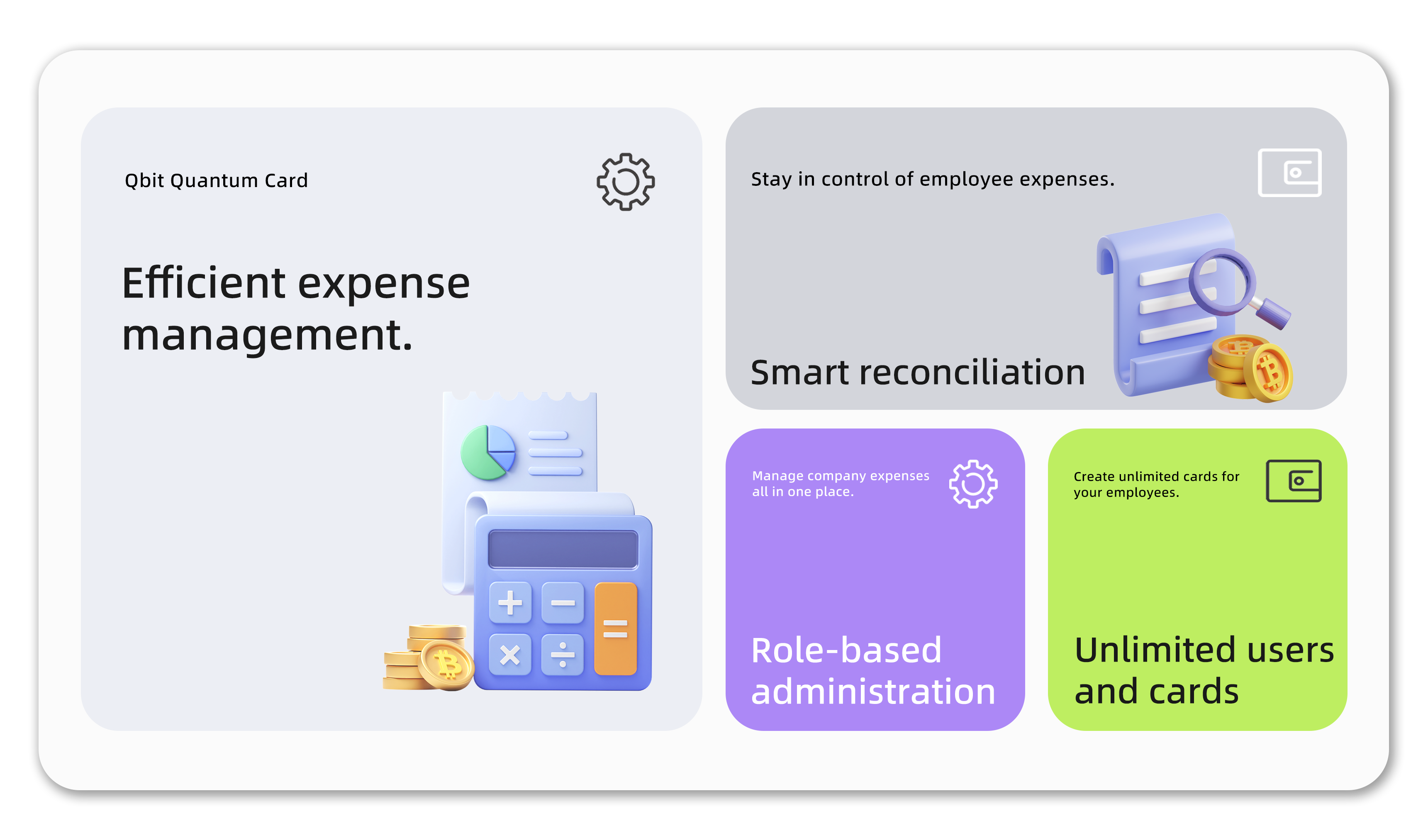

Qbit, a Neobank that provides one-stop overseas funds management services for global enterprises, has launched the Qbit Quantum Card, a solution that can meet the needs of enterprises for flexible card use in multiple scenarios, in response to a series of payment challenges that may arise in cross-border payments today.

Qbit Quantum Card supports all online payment scenarios that accept VISA/MasterCard such as Amazon, Shopee, Instagram, Twitter, etc. It supports batch card opening, online real-time card management, and provides intelligent expense management solutions for enterprises. Qbit Quantum Card can meet the needs of overseas enterprises covering multiple consumption scenarios and flexible card usage, covering overseas advertising, logistics and warehousing, corporate service subscription, travel and accommodation, and air ticket subscription, etc. It covers 180+ countries and regions and supports direct transactions in 40+ mainstream currencies, which can reduce the exchange loss between multiple currencies and improve the efficiency of enterprise capital utilization.

In addition to the virtual credit card, you can now apply for a physical Qbit card online, which supports ATM cash withdrawals for more flexible use of funds and maximizes the security and control of funds. You can apply for and use the Qbit Quantum Card with confidence and enjoy a smoother global payment experience!

*Follow Qbit to get more overseas information and learn more about the industry!