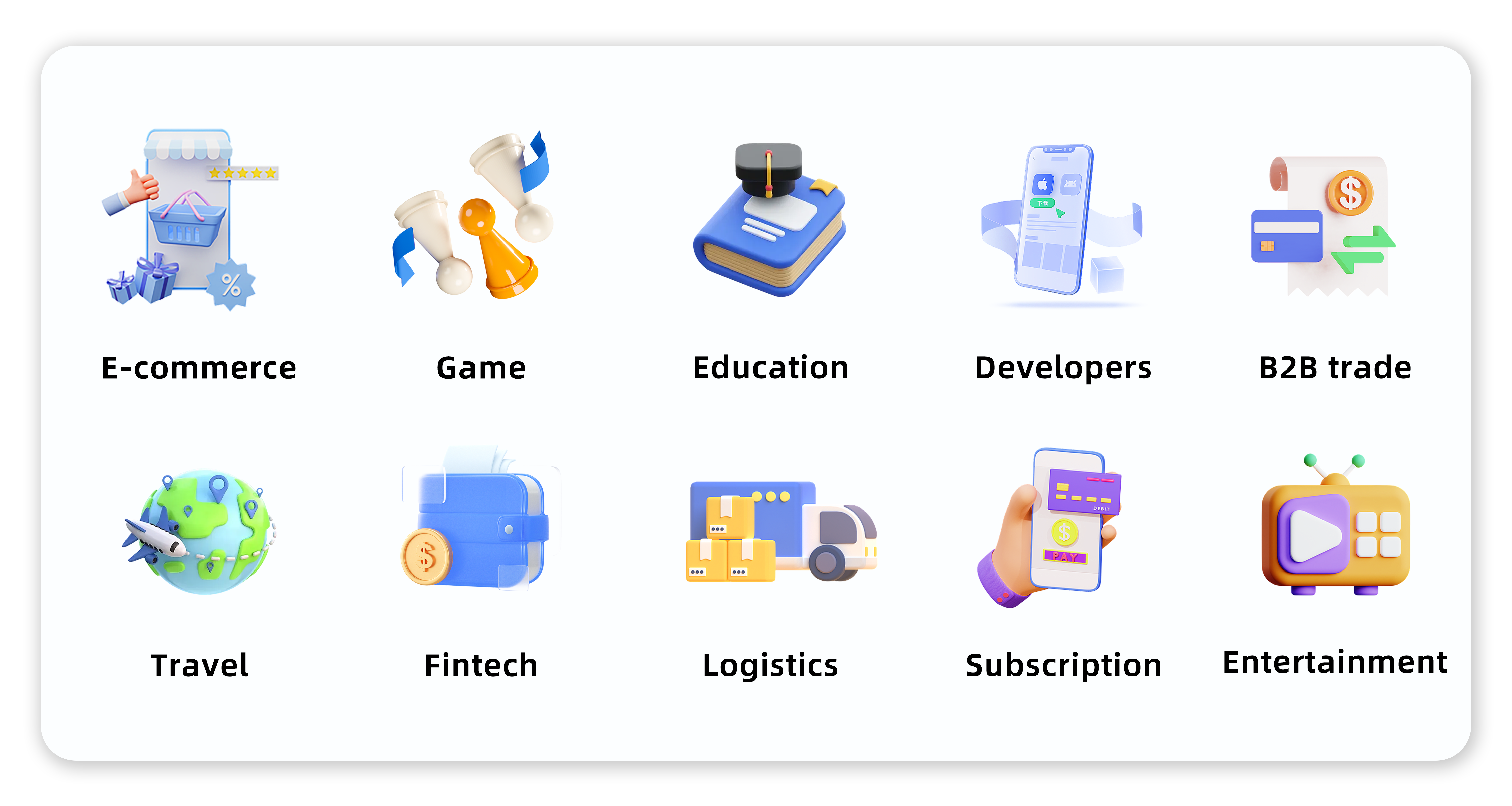

What are the application scenarios for virtual credit cards?

发布时间:2024-07-09

Nowadays, virtual credit cards are gradually becoming an integral part of our lives. Virtual credit cards support a wide range of application scenarios and are gradually gaining public recognition. In this issue, let's talk about the application scenarios and skills of virtual credit cards together.

E-commerce platform operating expenses payment

Virtual credit card can support the payment of various expenses of e-commerce operation. For example, platform store rent, station building SaaS application system costs (Shopify, bigcommerce, 3Dcart) and so on. In addition, virtual credit card can also be used for purchasing inventory, paying suppliers and processing refunds and other operations, providing a comprehensive payment solution for e-commerce operations.

Multi-platform advertising

Nowadays, major platform advertising is also an important channel for sellers to attract traffic. Enterprises can generate a separate virtual credit card for each advertising campaign, which is easy to track and control advertising expenditure and improve the efficiency of capital utilization. For example, when an enterprise places ads on Google Ads or Facebook Ads, it can use a virtual credit card to make payments, ensuring that every advertising expense is within a controllable range.

Business Travel

When arranging business travel for employees, companies can generate an exclusive virtual credit card for each employee, such as Qbit's employee card, which can be used to pay for airfare, hotel and other travel expenses. This not only improves payment transparency and security, but also simplifies the travel expense reimbursement and management process. For example, by using a virtual credit card when booking flights and hotels, employees can ensure that the costs are borne directly by the organization, avoiding the hassle of advancing expenses.

Subscription Services

Virtual credit cards are suitable for all kinds of subscription services. Such as upgraded subscriptions to AIGC tools like ChatGPT, Midjourney, software (Adobe Creative Cloud, Microsoft Office 365), and so on. Users can generate a separate virtual credit card for each subscription service, set limits and expiration dates to avoid auto-renewal and unnecessary expenses.

Image source: Qbit

All in all, it seems that virtual credit cards have a wide range of applications and can meet the payment needs of various scenarios. But how can you get a virtual credit card instantly and at low cost? You can choose a trusted virtual credit card service provider like Qbit to register and set up a virtual credit card to fully utilize the advantages of virtual credit cards in various scenarios in order to improve payment security and convenience.

Qbit supports online rapid application for Qbit Quantum Card, with rich card segments, unlimited number of cards and cardholders, support for on-demand customization, high payment success rate and stability to meet diverse payment needs; 0 cost to open the card, support for 40+ mainstream currencies transactions, to avoid the nuisance of foreign exchange losses.

In addition, in response to the frequent travel needs of enterprises, Qbit has also expanded the Qbit Employee Card, a customized card for corporate employees, so that team employees can quickly and efficiently make purchases or other business purchases during business activities without worrying about advancing expenses, and enjoy convenient global payments.

*If you need a Qbit Quantum Card, you can complete a convenient application online. Follow Qbit for more financial solutions!