Banking-as-a-Service

Embedded solutions for your business growth.

Receive global payments, pool your capital, and expand around the world with ease.

Talk to our specialists

Multiple scenarios we cover.

Cover diverse B2B and B2C use scenarios: trade, procurement, supplier payment, international remittance and more.

E-commerce

Fintech

B2B Trade

Games

Education

Apps Development

Logistics

Online Travel Platform

Unlock global opportunities wherever you are.

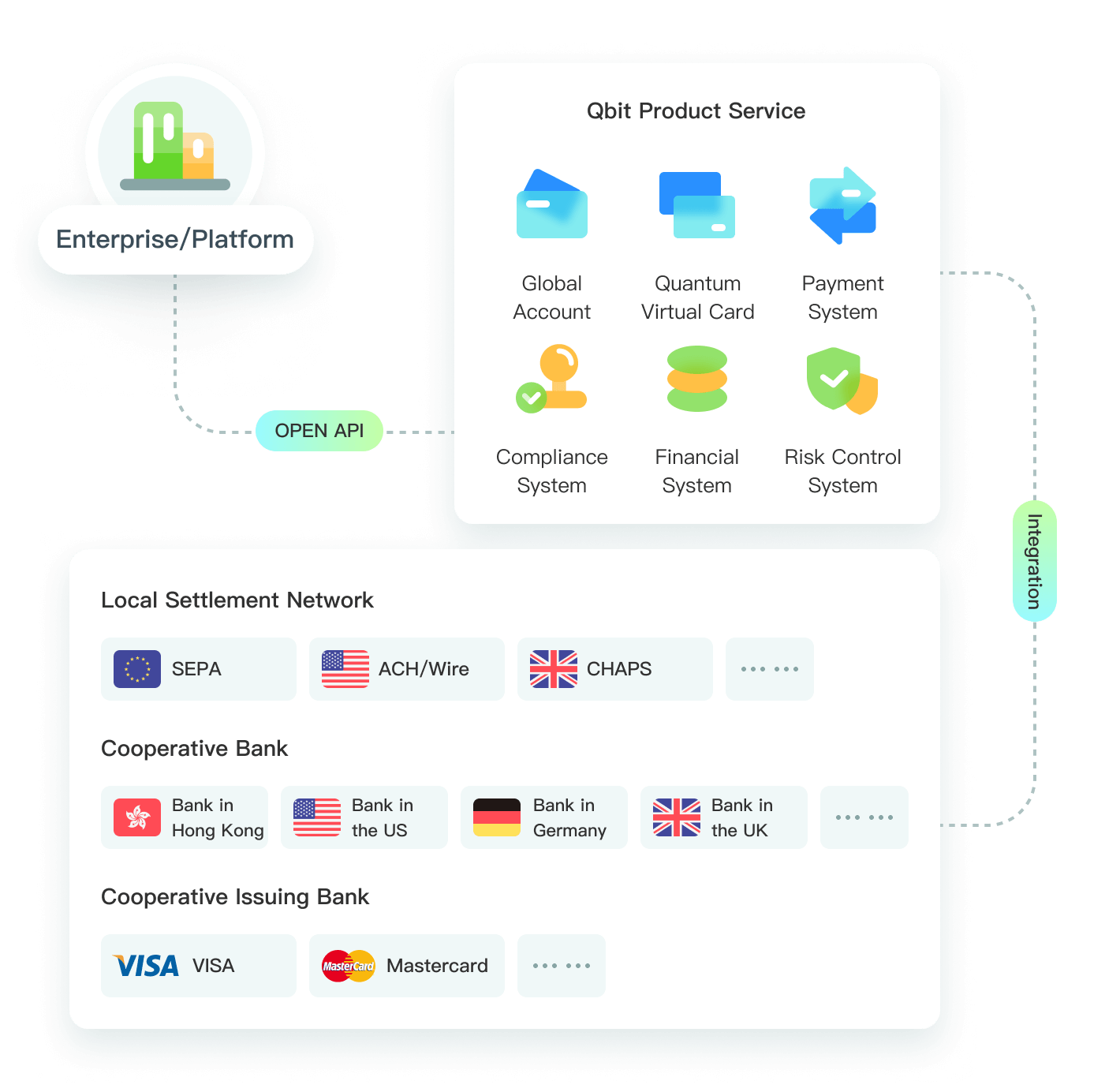

Seamlessly integrate accounts, multi-currency management, compliance, security, and business intelligence with our open ecosystem and APIs.

API Integration

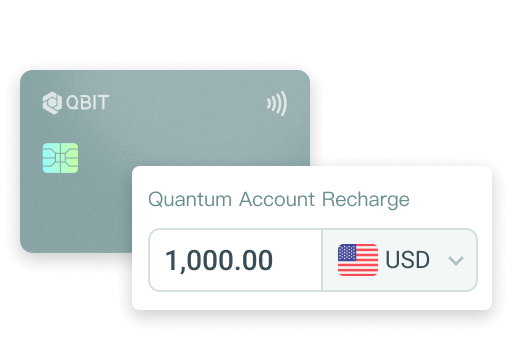

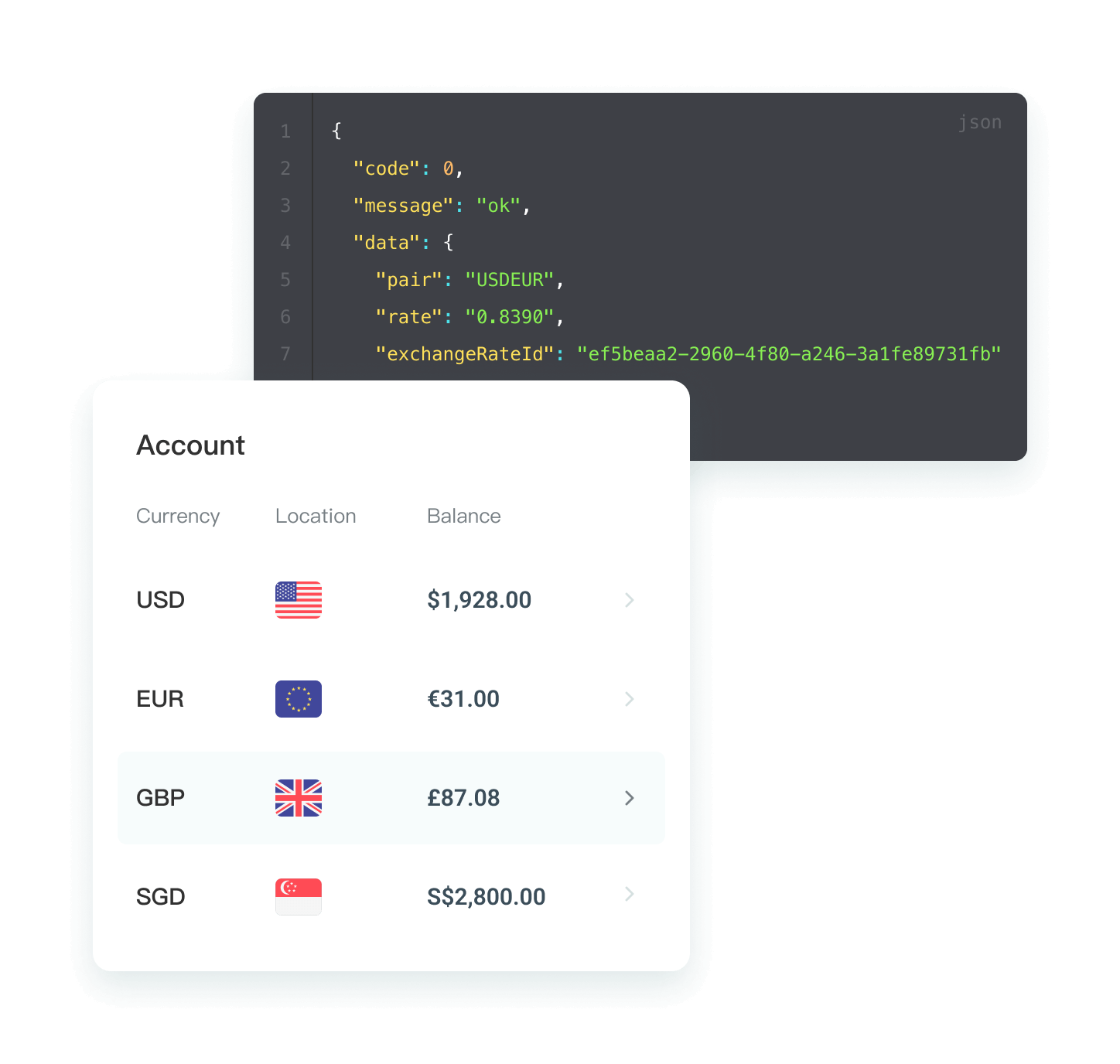

Supports multi-currency domiciled global accounts, quantum cards, cross-border payments and collections, foreign exchange.

Cash Management

An enterprise-grade cash management tool that covers the full spectrum of payment scenarios and makes it easy to track and manage multi-currency global accounts.

Payment Core

Automatic top-up of Quantum Card, Global account withdrawal and RMB e-wallet book transfer.

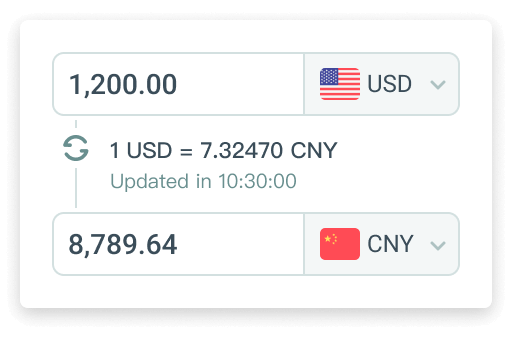

FX Rate

Efficient foreign exchange settlement service with transparent rate and unlimited settlement quota.

Trading Engine

High-performance trading engine automates transactions and manages risks, controlling and reducing latency.

Clearing Engine

Direct access to SEPA, ACH/Wire, CHAPS and other local clearing networks makes global transactions more stable and efficient.

Built for tech-forward global businesses.

Solve your customers’ global payments and financial services needs directly from your platform.

Global Account API

Open and manage business accounts in multiple currencies, receiving payments from different platforms.

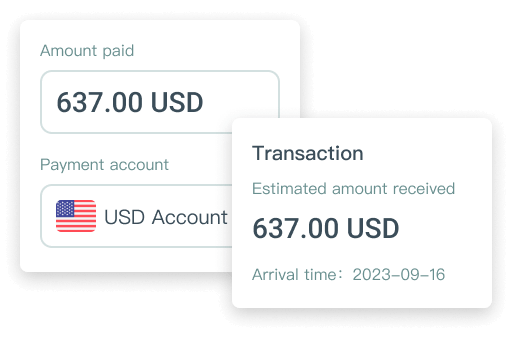

Deliver fast and secure domestic & cross-border payments, in the client’s preferred currency.

Simplify your payments through digitization.

Bulk payment API

Effortless API integration, automated pay-ins and pay-outs. Liberate your team from mundane tasks.

Expedite the process of settling multiple bills to vendors and suppliers with a few clicks.

Pay in real-time or schedule for future payments. Reduce workload and eliminate mistakes.

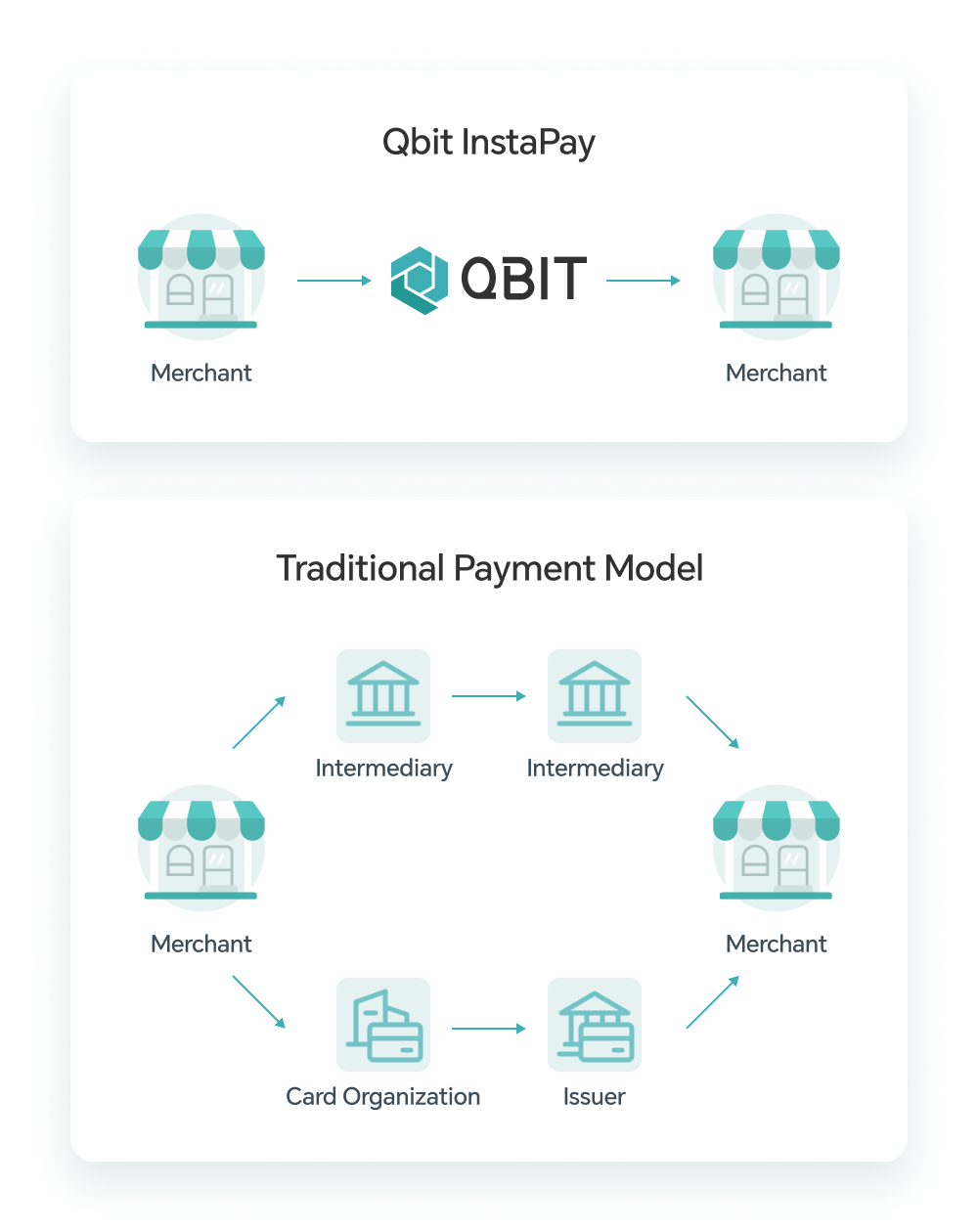

Qbit InstaPay

Instant payments between Qbit accounts.

Instant payments between Qbit accounts.

Designed for companies requiring rapid global transaction processing.

Lower Transaction Cost

Qbit InstaPay supports like-for-like settlement, eliminating high exchange fees, reducing transaction costs for businesses, and facilitating the flow of funds between Qbit multi-currency accounts.

Efficient Information Access

Quickly obtain the recipient's Qbit account information after authorization. You can also send requests for account information to the recipient.

Streamlined Payment Process

Connect with other Qbit users globally at a lower cost, enabling efficient money transfers in various scenarios and fostering collaboration within the ecosystem.

Integrated financial services.

The financial foundation for exponential growth.

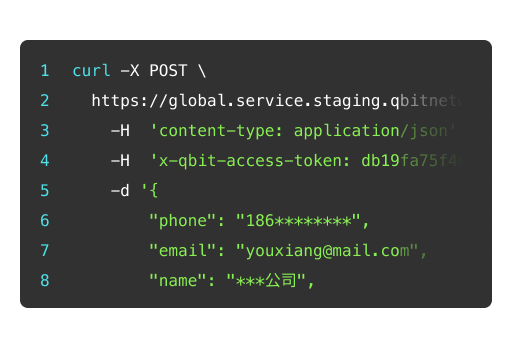

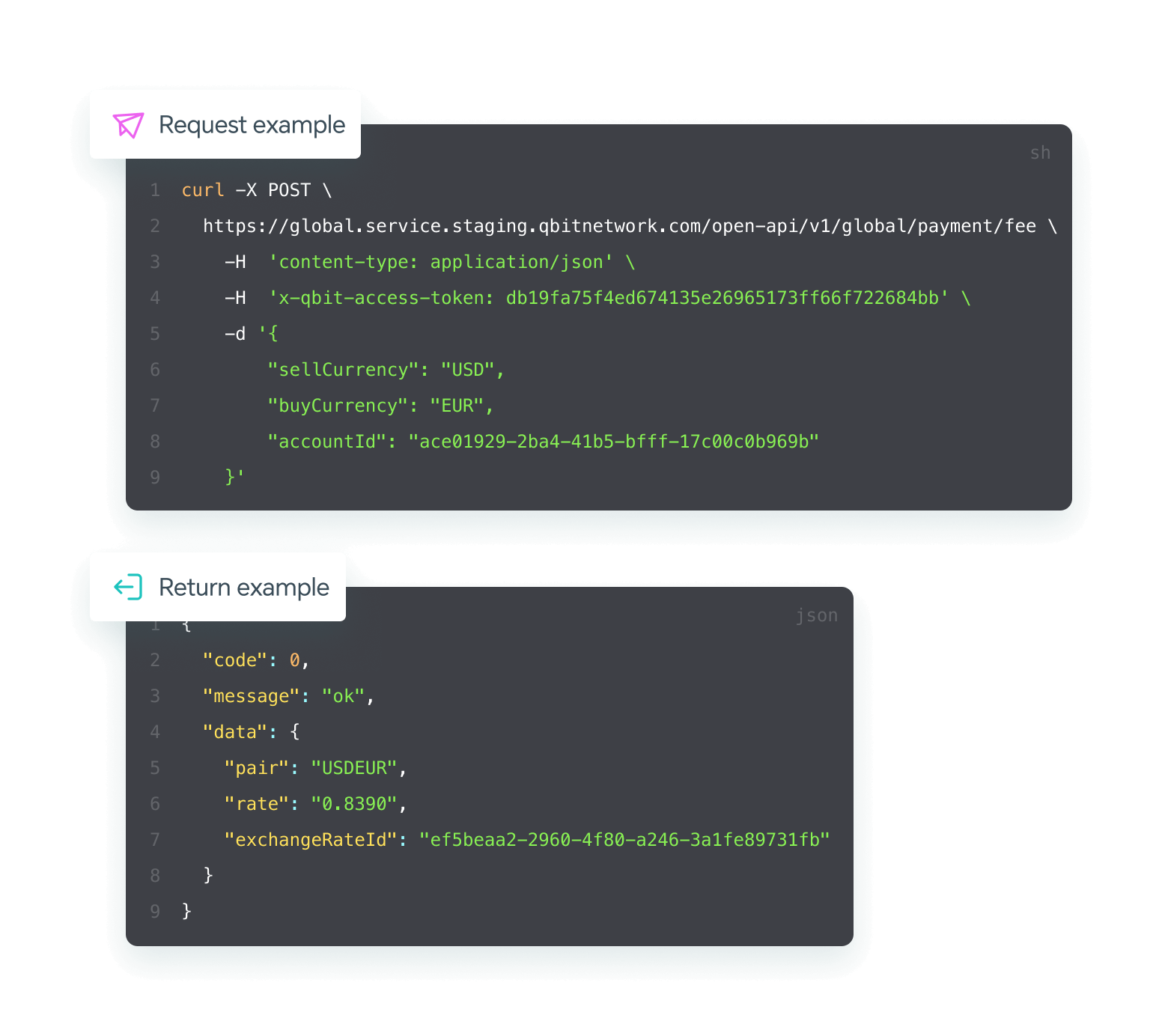

Best-in-class developer tools

Integrate in a fraction of the time with our high-quality developer capabilities, libraries, and APIs.

Pre-built components to simplify deployment

Decrease time to market with pre-built components and elements or build natively with a full API integration.

Flexible pricing controls

Set bespoke pricing for end customers including by transaction scenarios, use-cases, and products.

Dynamic processes based on local regulations

We dynamically adjust KYC information collection to meet local compliance requirements, based on country and business model.

Get Started

with Qbit.

Get started nowwith Qbit.

1. Contact Qbit Support Team

Assignment of sales managers and customer success teams.

2. Commercials & Pricing

Determine business strategy and confirm pricing proposals.

3. On-boarding Process

Submission of on-boarding documents.

4. Project Implementation

Technical Implementation

5. Technical Implementation

Technical team to answer questions and provide further training.

6. Go-live

Qbit team prepares production environment configuration and notifies customers.

Comply with global regulation and standards.

Bank-level AML/KYC and Fraud Monitoring system.

FDIC insured deposit of up to $250,000 for each depositor.

Fully compliant to level 1 PCI-DSS standards.

Powerful and flexible APIs to

help you scale.

Get fundedhelp you scale.

Zhejiang ICP B. 19050323 -1 Zhejiang Net A. B. No.33010402004040

Copyright © AILINGUAL LIMITED. All rights reserved.

Copyright © AILINGUAL LIMITED. All rights reserved.